Side Hustle Idea’s

If you are a person who would like an opportunity to earn extra, here are some ideas that you can …

E-scooters in Ireland

Motorbike and Scooter Insurance Ireland 2024

Best Web Design Companies in Ireland

Editor’s Pick

Listen to the Latest Episode of Fetch Your Online Goals

In Episode 4 of the Fetch Your Online Goals Podcast, Cian speaks with the Founder of Clarity Video, Gillan Williams. Gillan has decades of the award-winning film, publishing, marketing and brand management experience.

Meet The Team

Marketing

Sell Handmade Goods Online in Ireland

In an era where mass-produced items are the norm, handmade goods stand out for their uniqueness, quality, and the skill …

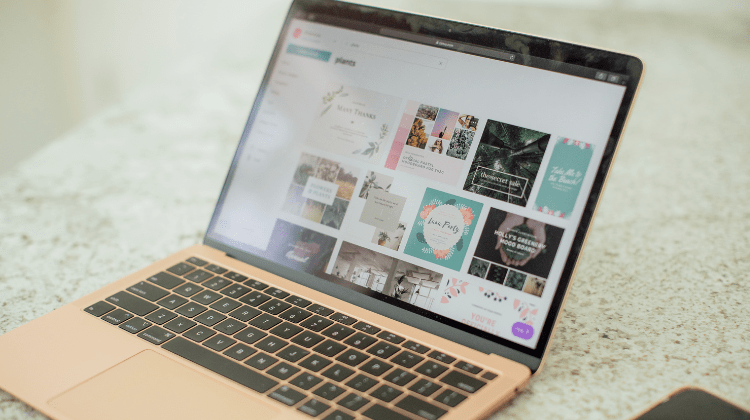

Best Marketing Tools

In the digital age, marketing has become a complex and multi-faceted discipline. To navigate this landscape, marketers need the right …

Digital Marketing Strategy

Digital marketing is a broad term that encompasses all marketing efforts that use an electronic device or the internet. Businesses …

Fetch Your Online Goals

Listen to the weekly marketing podcast

On Fetch Your Online Goals, we help you reach your online goals, whether it’s business, marketing or side hustle goals.

Money

Side Hustle Idea’s

If you are a person who would like an opportunity to earn extra, here are some ideas that you can …

Motorbike and Scooter Insurance Ireland 2024

Having trouble finding great value motorbike insurance? Shocked by your renewal quote? Unlike insurance comparison sites, which canvas insurers directly, …

Business

Best Web Design Companies in Ireland

If you’re looking for a web design company in Ireland we’ve put …

Sell Handmade Goods Online in Ireland

In an era where mass-produced items are the norm, handmade goods stand …

How to Become a Virtual Assistant

In the digital age, the demand for virtual assistants is skyrocketing. But …

Social Media

How To Get More Followers on TikTok

Summary Read this blog to learn the best tactics and tools that could help grow your following on TikTok and gain a more engaging audience. We feel these …

19 Social Media Content Ideas For Your Business

Running social media accounts for a business can be difficult, …

The Benefits of Social Media Marketing

Social Media Marketing is hugely beneficial to businesses no matter …